Planning for the years to come can be challenging, especially when considering your family's financial security. Life is full of curveballs, and a unexpected event can leave your loved ones vulnerable. That's where life insurance in Washington comes in. It gives a safety net, ensuring that your family has the financial support they need to cope in times of hardship.

- Consider the different types of life insurance available to find the ideal coverage for your needs.

- Consult a licensed insurance agent who can help you navigate the complexities of life insurance in Washington.

- Review your existing financial situation and aspirations to determine the appropriate amount of coverage.

By taking the time to understand life insurance, you can peacefully safeguard your family's future in Washington state.

Exploring Washington State Life Insurance: Finding the Right Coverage for You

Life insurance is a vital tool for securing your loved ones' financial future. In Washington State, researching the various types of coverage options available is crucial to ensure you find the policy that best meets your individual needs.

With a range of insurers and policy designs, it can be challenging to determine the right coverage for you. Nevertheless, by meticulously considering your circumstances, you can traverse this process and find a policy that provides the tranquility of mind you need.

A good place to start is by analyzing your economic obligations. Think about factors such as your earnings, outgoings, and any outstanding debts.

Additionally, factor the family members who rely on your financial support. Once you have a detailed understanding of your monetary picture, you can commence to investigate different types of life insurance.

Several common options comprise term life insurance, which provides coverage for a defined period, and permanent life insurance, which offers lifelong protection.

Understanding Washington's Life Insurance Landscape: A Guide for Consumers

Washington state presents a varied spectrum of life insurance options. For consumers seeking coverage, it can be tricky to navigate the best policy to meet their specific needs. This guide aims to assist Washington residents with the knowledge they need to click here make informed decisions about life insurance.

First by identifying your financial goals. Consider factors such as your age, dependents, and current coverage.

Once you have a clear understanding of your needs, explore different types of life insurance policies. Term life insurance are widely available options in Washington. Each type offers distinct advantages.

It's strongly recommended to meet a licensed insurance professional who can guide you through the selection process and answer any queries you may have. Be aware that choosing the right life insurance policy is an important step in securing your family's financial well-being.

Secure Your Legacy: Life Insurance Solutions for Washington Residents

As a citizen of Washington state, you understand the significance of preparing for your family's financial security. Life insurance provides a crucial protection plan in unforeseen {circumstances|. A well-designed life insurance policy can guarantee that your loved ones are financially protected if something befalls you.

There are various types of life insurance at your disposal in Washington, each with its own advantages. Reach out to a licensed financial advisor to determine the best policy to address your unique goals.

Providing Washington Communities with Expertise

Are you looking for reliable life insurance coverage in the heart of Washington? Look no further! As a dedicated passionate about life insurance agent, I'm well-versed to assist you understand the complex world of life insurance. With extensive knowledge of the Washington market and my dedication to client satisfaction, I'm sure to develop a tailored plan that meets your unique needs.

No matter your age, I'm here to provide expert advice to help you achieve long-term security. Let me work alongside you in protecting what matters most: your loved ones' future.

Seeking Your Trusted Partner for Life Insurance in Washington State

Are you searching for comprehensive life insurance coverage in the vibrant state of Washington? Look no further than our committed team of financial advisors. We are driven about helping individuals and families like yours secure peace of mind through tailored life insurance plans.

With a deep understanding of the distinct needs of Washington residents, we offer a comprehensive range of policies to suit your specific circumstances.

Our expert agents are available to walk you through the entire process, from initial consultation to policy selection. We endeavor to make the life insurance experience as easy as possible.

- Rely in our proven track record of providing exceptional support.

- Gain from our affordable rates and adjustable policy terms.

- Contact with us today to book a free consultation and explore how we can help you secure your loved ones' financial future.

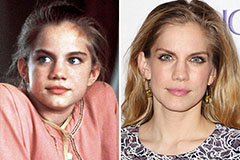

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!